See how virtual branches are transforming banking.

Download the latest insights in our 2023 report.

Solutions > Use case > Virtual branch

Deliver in-branch service without the branch — with a virtual solution built for today's digital-first account holders.

As account holder needs evolve and your footprint remains fixed, Lynq® by Agent IQ gives your institution the tools to extend the full value of the branch — digitally.

Whether they click through your website or digital banking app, account holders can connect instantly with the right internal staff — no scheduling, no downloads, no delays.

With Lynq, they get access to:

Real-time document sharing and delivery

Co-browsing for guided application walkthroughs

eSignature (Docusign or Adobe Sign) support

Step-up verification for added security

And personalized service from anywhere — even at home

It’s more than a video call. It’s a true digital relationship banking experience — branch-quality service, reimagined for a digital world.

Lynq eliminates the need for costly physical expansion. Your internal staff can work from a branch, office, or remotely — and still deliver high-touch service to account holders wherever they are.

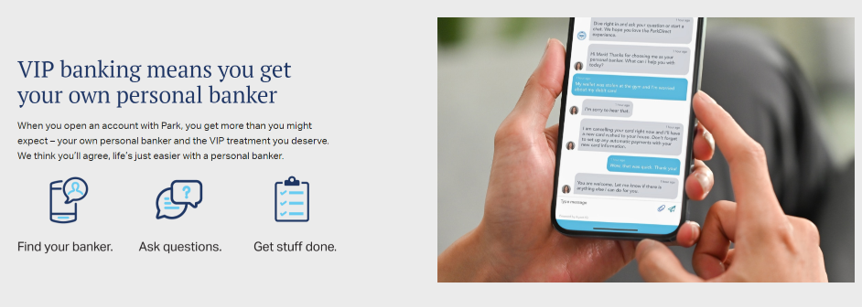

Explore how clients like Park National Bank are using Lynq to position their relationship banking strategy with virtual-first customers.

See how virtual branches are transforming banking.

Download the latest insights in our 2023 report.

Through the use of our PCFCU Connect App we have transformed our member interactions to be more personal, meaningful and productive.

Tiffany Miller

VP Marketing & Technology

Park National Bank is no stranger to extending their personal service beyond the branch.

Every institution is different. Let’s connect to discuss how Lynq can help you expand your reach and deepen relationships.