Products > Relationship banking

Real banking is about relationships

Discover the 4 foundational pillars that can help you extend your relationship banking experience beyond the branch.

Financial Institutions all have a fundamental value to serve their account holders by understanding their unique needs and providing products and services that can help them achieve a better financial life. And the ultimate way to understand what your account holders need is to connect with them and create trusted relationships.

This works incredibly well and has for over a century when those account holders came into the branch. But as technology allows more flexibility and convenience, account holders aren't coming into the branch as much and are demanding a more digital experience from their institution.

of users wait for their primary banker

of digital account holders have selected their personal banker

higher average balances when account holders have a personal banker

Lynq® by Agent IQ is the only digital platform that delivers on the four foundational pillars of relationship banking and extends them beyond the branch.

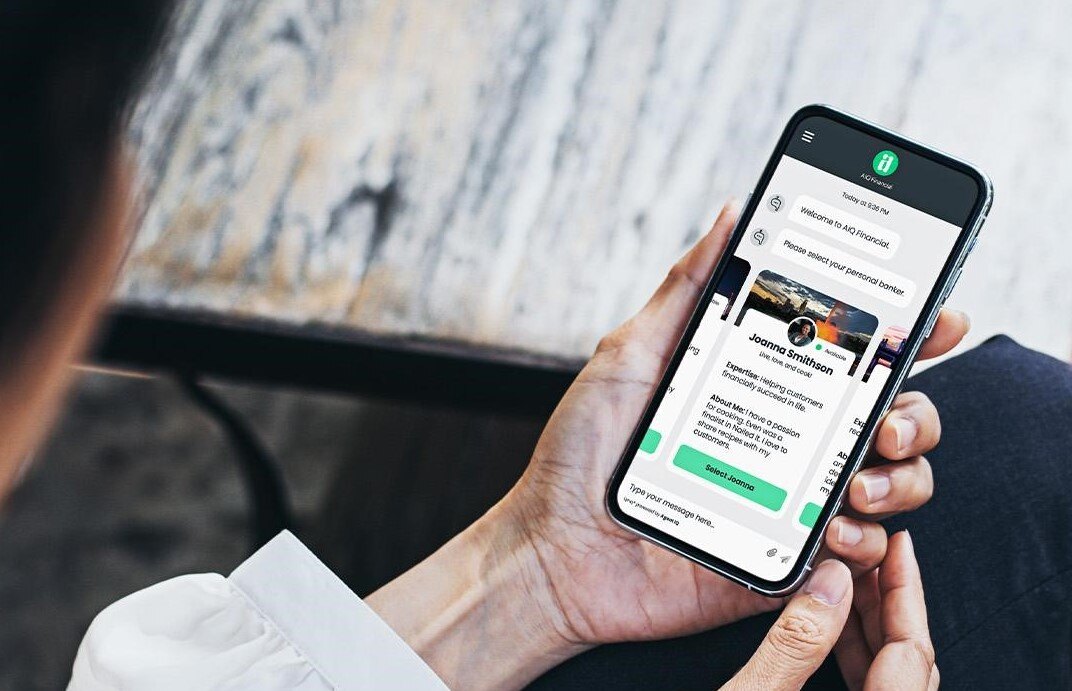

Pillar 1: Personal

Lynq allows your account holders to select and engage with a personal banker who can be their primary point of contact for your institution. Subject Matter Experts can be invited to join the conversation at any time and as needed. The conversation can seamlessly extend to video chat and co-browsing. And with Lynq’s built-in real-time translation ability, account holders can always feel comfortable communicating in their native language.

Pillar 2: Persistent

Nobody likes to repeat themselves. And this couldn’t be more true when your account holder is looking to you for advice or support. That’s why with Lynq, all conversation threads are persistent so you always pick up the conversation right where you left off. This builds trust and provides an optimal experience for both your account holder and your internal staff

Pillar 3: Proactive

A good relationship means always being there for each other; not just one sided. So why should your relationships with your account holders be any different? Don’t just wait for them to come to you with a problem or challenge. With Lynq, your internal staff is able to proactively send push notifications to account holders either one-to-one, or to a larger book of business.

Pillar 4: Profitable

Relationships should benefit all parties involved which also applies to your relationships with your account holders. The Lynq platform automatically tags all conversations and uses built-in AI to deliver insightsinto what your account holders are talking about. Armed with insights like these, your staff can use the Lynq platform to provide timely and personal advice and support which benefits your account holders and can bring you a greater share of wallet.

When the need is simple

There are many times when an account holder need is simple and that’s where our AI self-service can provide efficiencies by providing answers to frequently asked questions freeing up internal staff to handle the more complex needs.

Engage when convenient, not just when available

The beauty of texting your friends is that you can send your message knowing that they will get it and reply when they can. This asynchronous communication allows for both sides to communicate their thoughts or needs and have that responsibility off of their shoulders, while being confident that the response will come when convenient. The Relationship Banking package of the Lynq platform is designed to support exactly this. Account holders can ask a question at 11pm when they are thinking about their need, and rest assured that their banker will get the message and respond in the morning when they are free.

Want to learn more about relationship banking?

We understand that every financial institution has unique operations and strategic initiatives that they are focused on. Request a demo with us below and we will look forward to understanding your unique challenges and having a discussion on how Lynq by Agent IQ can help you achieve those goals.