Services > AI for account holders

AI self-service that boosts efficiency and satisfaction

Allow customers to get quick answers to the simple questions without waiting on hold.

Fast, efficient, and always available

In today’s fast-paced world, account holders expect instant answers to their questions. But when simple queries get delayed by long hold times or slow responses, it can lead to frustration and dissatisfaction. This is where Lynq’s AI-powered self-service platform steps in, offering a seamless, efficient, and frustration-free solution for both account holders and financial institutions.

Let AI handle the simple questions—quickly and accurately

For simple, routine questions like “What’s my routing number?” or “Where do I send my credit card payment?”, waiting on hold or waiting for a reply from a personal banker can feel like an eternity. Lynq’s AI-powered platform uses natural language processing (NLP) to instantly understand and answer these questions in real-time. By automating responses to common inquiries, Lynq not only ensures a faster, more satisfying experience for account holders but also frees up your staff to focus on more complex issues. This allows institutions to significantly reduce call center volume, increasing efficiency across the board.

Customizable AI journeys for different account holder needs

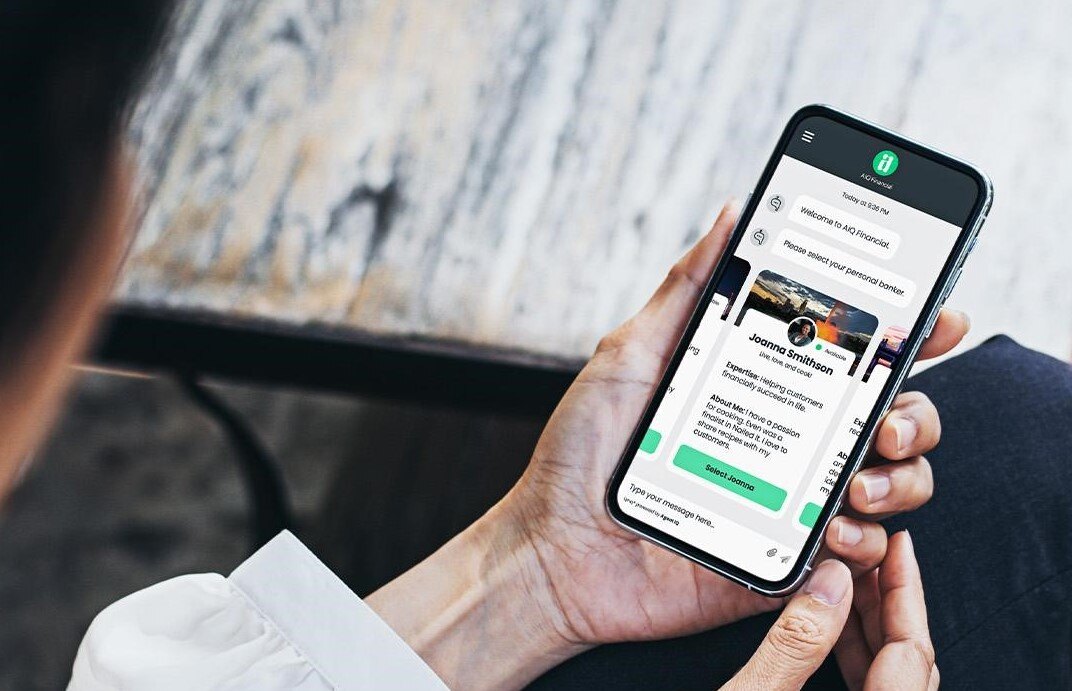

Every account holder is unique, and their needs may vary depending on where they are on their journey. Lynq’s AI is fully configurable, allowing financial institutions to create tailored experiences based on account holder segments or even the point of entry into the chat. Whether the user is initiating a conversation from a mobile app, website, or another touchpoint, the AI adapts to the context and provides relevant answers with minimal friction. This personalized approach ensures that account holders feel supported, no matter their query, without waiting for human assistance.

AI that never hides the human

Despite the impressive capabilities of AI, sometimes a simple answer is just not enough. At Lynq, we believe in combining the power of automation with the warmth of human interaction. If an account holder’s issue cannot be fully resolved by the AI, they are always just one click away from speaking with a real person. This “escape hatch” ensures that customers are never trapped in a frustrating, endless loop of automated responses. It’s all about providing the right balance between automation and human support, ensuring the best possible experience for account holders without compromising service quality.

Achieving substantial efficiency gains

Lynq’s AI platform can handle up to 80% of all customer inquiries without any human intervention, greatly reducing the burden on call centers. In fact, institutions using Lynq report up to a 70% reduction in overnight call center volume, allowing their staff to focus on high-value, more complex customer interactions. By seamlessly handling routine inquiries, Lynq’s AI creates significant efficiencies, while still providing an option for personalized support when needed.

overnight call center volume reduction

self-service on public site with zero complaints

agents support 30,000 account holders

Enhanced customer satisfaction and reduced operational costs

With Lynq, institutions can ensure that their account holders always get the answers they need—quickly, accurately, and at their convenience. Whether it’s after hours, during peak times, or on weekends, AI-powered self-service is available to assist. This leads to not only a smoother customer experience but also improved operational efficiency, helping your institution stay competitive and future-proof in an increasingly digital world.

By embracing Lynq’s AI self-service, financial institutions can improve service delivery, boost customer satisfaction, and reduce costs—all while enhancing their staff’s ability to focus on higher-value tasks. This is how AI can truly transform the way you serve your account holders.

Want to learn more about relationship banking?

We understand that every financial institution has unique operations and strategic initiatives that they are focused on. Request a demo with us below and we will look forward to understanding your unique challenges and having a discussion on how Lynq by Agent IQ can help you achieve those goals.