Products > Lynq® Relationship Banking

Turn digital interactions into deeper relationships and measurable growth

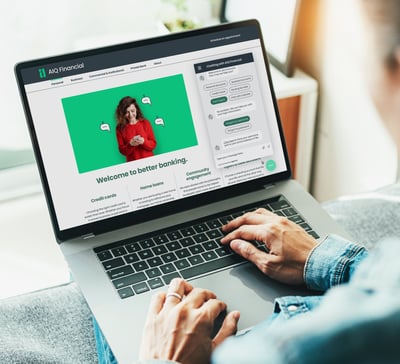

Lynq is the AI-powered relationship banking platform that helps banks and credit unions engage account holders across acquisition, adoption, expansion, and retention—turning every interaction into an opportunity for growth.

Why relationship banking matters

Digital banking has made access easy, but connection harder. Account holders expect speed and convenience, yet still want to feel recognized and supported. Lynq helps you bring the personal, trusted experience of the branch into every digital interaction. You get a single platform that unites human service and AI intelligence to grow relationships, not just manage transactions.

How Lynq supports every stage of your account holders' lifecycle

Acquisition

Attract and convert new account holders with personalized digital experiences that feel human. Use AI-powered onboarding, guided self-service, and the ability to connect every new customer with a selected banker or banker team from day one.

Outcome: Faster conversion, higher satisfaction from the start.

Adoption

Drive early engagement by promoting adoption of key services such as mobile banking, card activation, or bill pay. Lynq orchestrates contextual outreach with personalized prompts, guided interactions, and timely messages that build confidence and trust.

Outcome: Shorter time to active use and stronger engagement from the start.

Expansion

Deepen existing relationships by identifying and acting on new opportunities. Lynq surfaces insights and next-best offers, enables proactive banker outreach, and automates follow-ups across channels to increase product penetration and household value.

Outcome: More products per account holder and higher share of wallet.

Retention

Sustain long-term relationships with ongoing engagement, proactive check-ins, and frictionless support across digital and human channels. Lynq helps your teams build loyalty, resolve issues quickly, and retain more of your most valuable account holders.

Outcome: Lower churn and higher advocacy.

Platform features and capabilities

AI that works for everyone

-

AI self-service: Always-on virtual assistant that handles routine inquiries, balances, and FAQs with institution-specific knowledge.

-

AI-assisted staff: Suggests relevant responses, shares documents, and tags topics in real time to increase productivity.

-

AI-powered insights: Translates conversational data into actionable analytics that inform product, service, and growth strategies.

Unified engagement tools

-

Messaging, video, and co-browsing: Connect with account holders through their preferred channel without losing context.

-

Persistent conversation history: One thread that follows the account holder, ensuring continuity and personalization.

-

Secure document exchange: Enable digital signing, ID verification, and file transfer within the same conversation.

-

Real-time translation: Support multilingual communication instantly for more inclusive service.

Built for financial institutions

-

Digital platform integrations: Seamless integration with Q2, Narmi, Jack Henry Banno, FIS, Fiserv, Lumin, Apiture, and more.

-

Configurable experience model: Tailor the engagement to your institution's operating model by account holder segment whether it is individual banker, team-based, or pooled service.

-

Compliance ready: SOC 2 Type II certified, hosted on U.S.-based AWS environments with full encryption at rest and in transit.

-

Single-tenant architecture: Ensures data separation, client ownership, and enterprise-grade security.

Analytics and visibility

- Staff performance insights: Identify top performers and efficiency gains from AI-assisted workflows.

-

Operational reporting: Export and analyze engagement trends to guide strategy and optimize growth programs.

Results that speak for themselves

higher average balances with a personal banker

of users wait for their primary banker

of digital customers have selected their own banker

Curious to see how Lynq works?

Talk with our teamDesigned for your teams

-

Retail banking – Extend branch-level service into digital channels to build stronger, more profitable relationships.

-

Contact centers – Use AI and smart routing to deflect routine inquiries, increase first-contact resolution, and reduce workload.

-

Business banking – Help small business clients connect directly with their banker for faster decisions and deeper partnerships.

-

Wealth and private banking – Support high-touch relationships with digital convenience while keeping advisors focused on what matters most.

See what makes Lynq the only platform built for true relationship banking

Share

Park National Bank shares how their ParkDirect service powered by Agent IQ provides digital convenience with human connection.

We’ve always believed in differentiating our bank through building relationships. Now, we can do that in a whole new way.

Michelle Hamilton

CMO

Ready to turn every interaction into an opportunity?

Let’s explore how Lynq can help your institution grow by building deeper digital relationships.