What’s on the 2026 holiday IT wish list for credit unions?

Read more

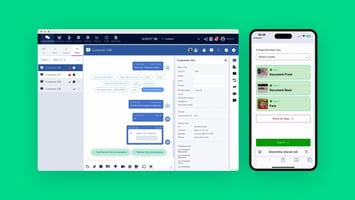

Lynq® by Agent IQ

The relationship banking platform powered by AI that turns everyday interactions into opportunities for growth.

Lynq is the leading AI relationship banking platform that keeps them coming back for every financial need.

Attract and convert through digital experiences

Drive momentum through digital activation

Sustain loyalty through persistent connection

Increase product adoption and deepen relationships

of account holders prefer to wait for their personal banker

applications being funded when engaged with chat

conversations are about new products

of all chats handled by AI self-service

overnight call reduction

call handling rate due to call volume reduction

of typical bank customers do not visit a branch

of customers of tech first organizations never visit a branch

of digital SMB customers have selected their own banker

of account holders prefer to wait for their personal banker

average age of Lynq users

users on the platform

total monthly conversations

consumer check their text messages within 5 min

more likely to respond to a collection text than a phone call

reduction in delinquency when getting loan reminders

Our Lynq platform enables your bank to build stronger customer relationships by allowing customers to select and engage with a personal banker through whatever digital channel is convenient for them at the time. Conversations are persistent so no need for anybody to repeat themselves and because of that established trust, bankers are able to proactively reach out to their customers one-to-one, or to their book of business. Built-in AI efficiencies support your customers to get service for easily answered questions freeing up valuable banker time.

of digital customers have selected their own banker

of relationship banking customers have more than one deposit account

overnight call center reduction

Deliver service and support for your members when they don't come into the branch. Provide seamless digital access to internal staff that is persistent so members feel heard and don't have to repeat themselves the next time they engage. AI self-service can quickly reduce call center volume and provide a better experience for your members to receive 24/7 support no matter where they are.

self-service on public site with zero member complaints

overnight call reduction

applications being funded when engaged with chat

Streamline your due diligence, admin processes, and workflows with enhanced collaboration features that allow seamless communication across internal teams, vendors, and client segments, creating a more unified, responsive, and productive organization.

users on the platform

total monthly conversations

Our goal was to blend the best of both human emotion and empathy with the speed and efficiency of computer intelligence.

Brianna Elsass

VP & Head of US Digital Servicing & Technology

We were initially looking for a simple chat replacement service, but the Lynq platform by Agent IQ delivered so much more benefit — cost efficiencies and a superior member experience.

Robin Binford

AVP, Member Services

Read more

Read more

Read more